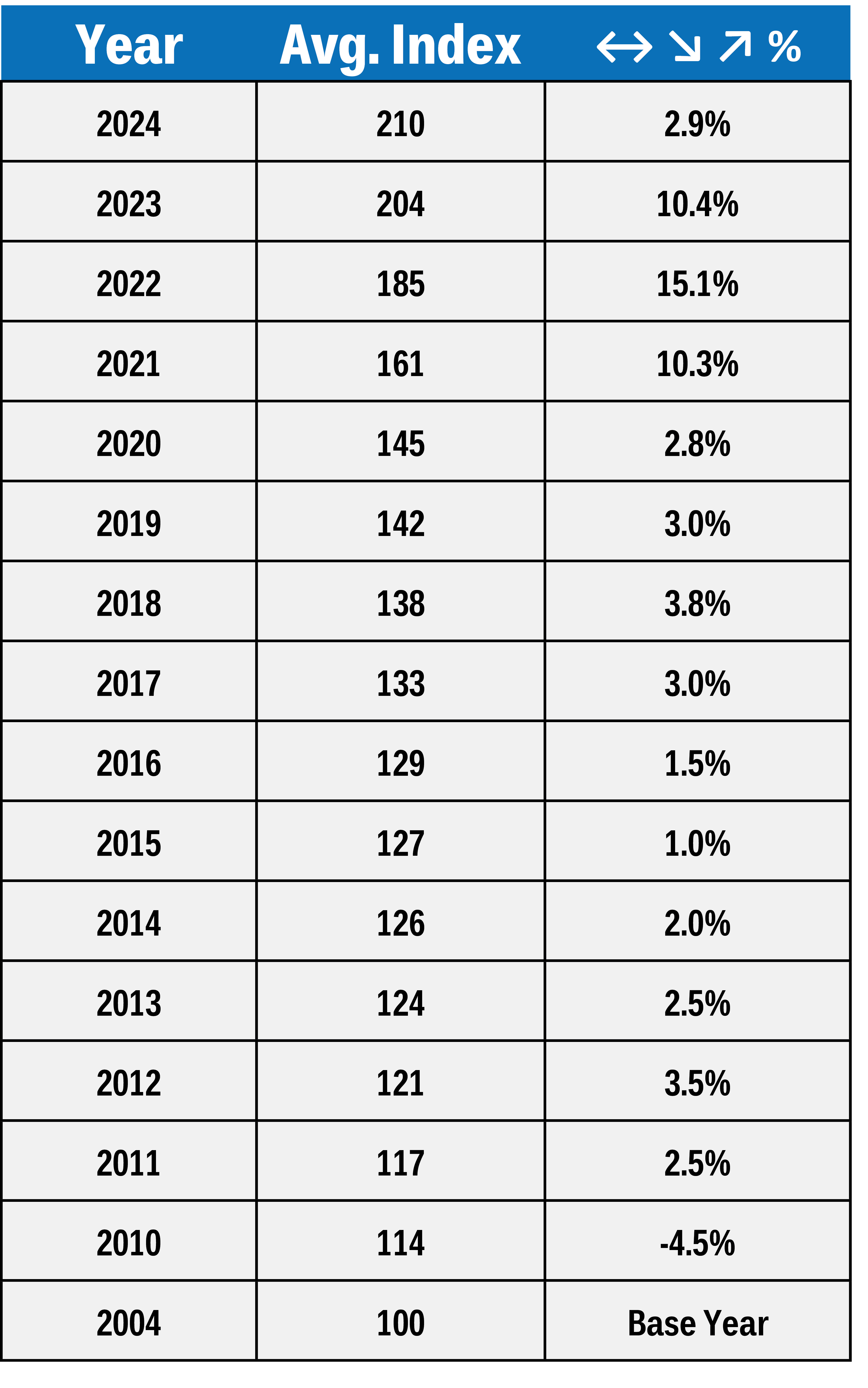

Equipment Cost Index

SourceBlue has raised the MEP Index to account for high market demand, raw material availability, and energy costs for fourth quarter of 2024.

The past two weeks have created intense speculation and reactions on the impacts to the equipment supply in reaction to the US East / Gulf Coast port strike and recovery from Hurricane Helene. As the supply chain continues to recover from these events, it is imperative for stakeholders to explore strategies to enhance resilience and mitigate the impact of future disruptions.

Year to date industry data for 2024 versus the same time in 2023 shows electrical equipment orders increased (+.7%) and shipments also increased (+1.7%). For the same time period, mechanical equipment orders increased (+8.8%) and shipments increased (+9.1%).

| Estimated Equipment Lead Times Varies Due to Equipment Sizing |

||

|---|---|---|

| Equipment Type | Previous | Current |

| Cooling Towers | 14 - 32 wks | 16 - 30 wks |

| Chillers | 30 - 85 wks | 20 - 85 wks |

| Air Handling Units | 20 - 50 wks | 20 - 50 wks |

| Generators | 60 - 156 wks | 50 - 140 wks |

| Switchgear | 32 - 80 wks | 30 - 80 wks |

| Uninterruptible Power Supply | 18 - 45 wks | 20 - 45 wks |

| Lighting Fixtures | 10 - 12 wks | 10 - 16 wks |

| Lighting Controls | 14 - 24 wks | 12 - 26 wks |

The recent port strike, which ended after three days with a tentative agreement, initially disrupted manufacturing, but companies had stocked essential components to mitigate the impact. This led to a surge in demand for rail, airfreight, and trucking, resulting in higher rates and capacity constraints, particularly for time-sensitive shipments. The ongoing effects of Hurricane Helene have compounded these challenges, causing significant damage to manufacturing facilities and disrupting operations across various sectors. Flooding and power outages have delayed production restarts, with many factories facing over two weeks of downtime. The human impact is severe, as many workers are displaced and dealing with personal losses, which further exacerbates labor shortages and logistical issues. As the industry faces longer recovery periods and increased costs, the combination of these events highlights vulnerabilities in the broader logistics network.

Average Index History

Do you have a construction project that needs procurement and sourcing expertise? Partner with SourceBlue for exceptional results.