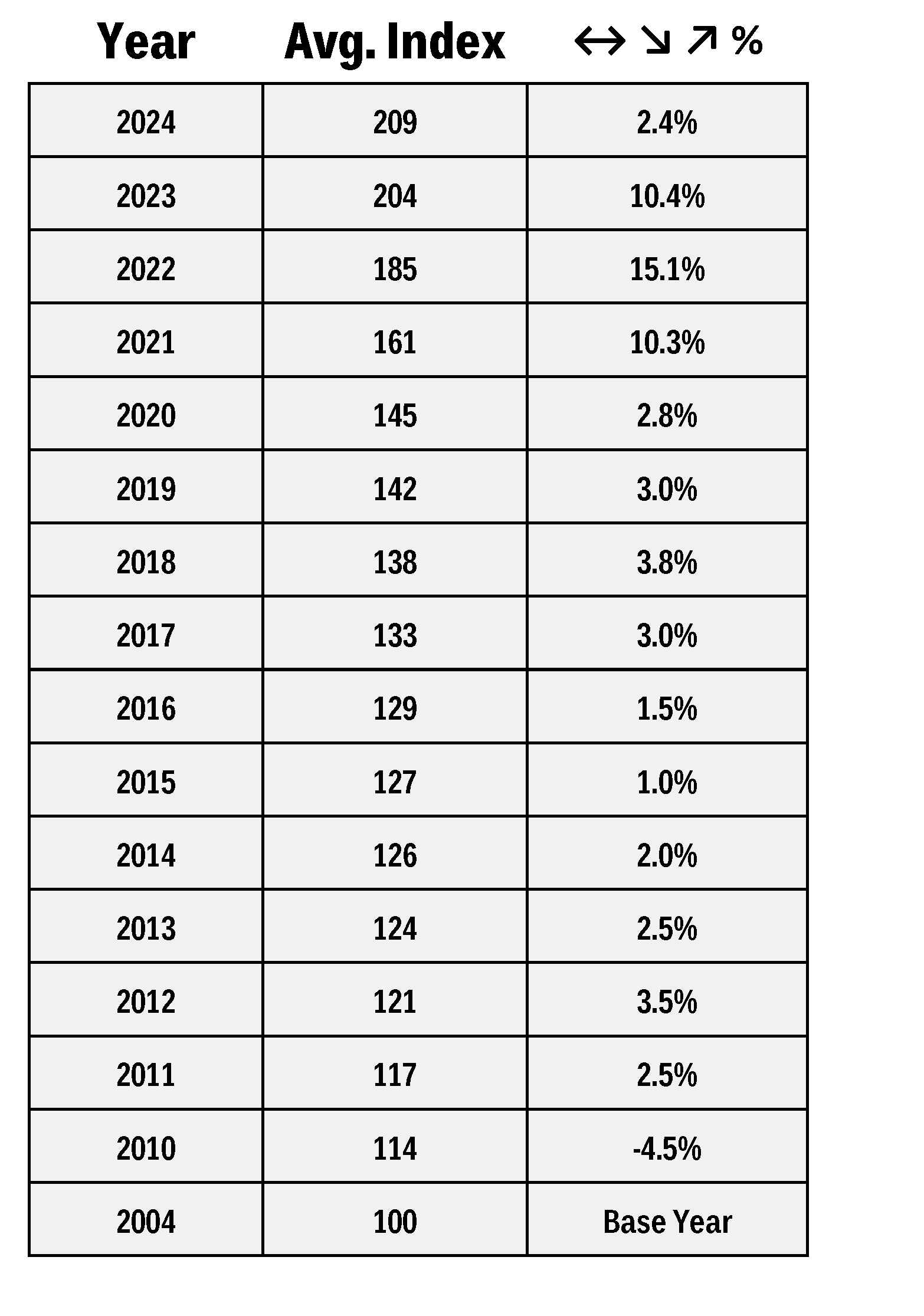

Equipment Cost Index

SourceBlue continues to forecast an over increase of 2.4% in equipment pricing for the first half of 2024, keeping the index at 209. Reviewing the 2025 supply chain demand planning combined with taking into account current factory loading and a slight decline in electronic component inventory, the MEP index is anticipated to rise during the final quarter of this year.

Year to date industry data for 2024 versus the same time in 2023 shows electrical equipment orders increased (+1.7%) and shipments also increased (+2.6%). For the same time period, mechanical equipment orders increased (+1.0%) and shipments increased (+2.1%).

We will continue to provide updates on price increases and any significant supply chain information as it becomes available.

| Estimated Equipment Lead Times Varies Due to Equipment Sizing |

||

|---|---|---|

| Equipment Type | Previous | Current |

| Cooling Towers | 16 - 32 wks | 14 - 32 wks |

| Chillers | 25 - 65 wks | 30 - 85 wks |

| Air Handling Units | 16 - 50 wks | 20 - 50 wks |

| Generators | 50 - 130 wks | 60 - 156 wks |

| Switchgear | 32 - 80 wks | 32 - 80 wks |

| Uninterruptible Power Supply | 16 - 34 wks | 18 - 45 wks |

| Lighting Fixtures | 10 - 12 wks | 10 - 12 wks |

| Lighting Controls | 16 - 20 wks | 14 - 24 wks |

Centrifugal chiller lead times are topping out at eighty-five (85) weeks as the large-scale Data Centers, Semi-Conductor, and EV plants are consuming manufacturing capacity. Large tonnage watercooled centrifugal chillers lead times have increased to 70 – 75 weeks, and air-cooled centrifugal chillers have increased to 85 weeks. New air cooled, centrifugal manufacturers from other markets have started entering the US to help address the demand and capacity issue with such strong demand from large scale projects.

The UPS and ATS product lines have pushed out lead times in the first two (2) quarters this year. The change is the result of increased number of orders and size of orders. Most factories are close to maximum capacity with this increased demand. This trend is expected to continue through the end of this year with UPS lead times peaking at 40-45 weeks and ATS with Bypass at 50-54 weeks.

Average Index History

Do you have a construction project that needs procurement and sourcing expertise? Partner with SourceBlue for exceptional results.